Ideal Tips About How To Check Your Ein

Step 1 go to the tax exempt organization search page on the irs website.

How to check your ein. The easiest way to find your ein is to dig up your ein confirmation letter. Since an ein is required for a business bank account, the bank is a good source for. Ein contains special internal format.

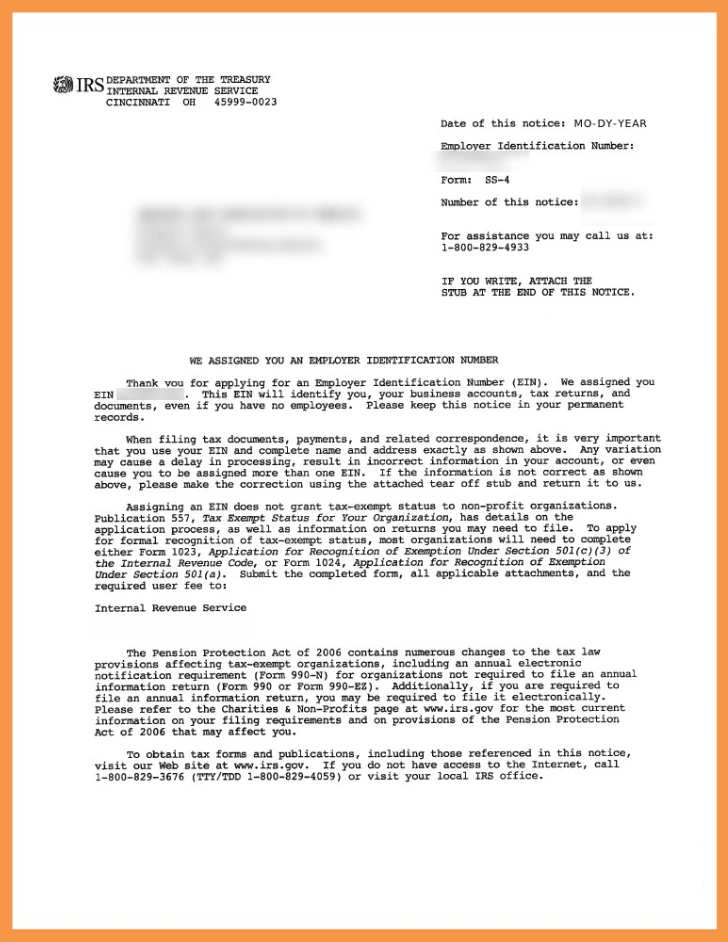

The application includes embedded help topics and. This notice is issued as a confirmation of your. The irs sends out an ein confirmation letter when new businesses are registered.

This report provides a credit score, a credit summary, an analysis of your company's payment trends, and a listing of public records, such as bankruptcies, liens, or. How to find your ein online. Check your ein confirmation letter.

The big three credit bureaus (transunion, equifax, and experian) can provide ein for a fee. The best way to apply for your ein is to do it online. Ways to find your business ein number.

How to get an ein confirmation letter from the irs. Employer identification number (ein) online validation service. If you’re still uncertain about whether or not your information is correct, there are a number of ways for you to confirm it.

How to call the irs to get your ein: If you previously applied for an ein and have forgotten it, here are a few possible ways to look up your business tax id number. Add others to your project.see add users to a project or team.you can only invite users who are already in your.